Ukrainians reminded of mandatory taxes in Poland: what refugees have to pay.

Ukrainians in Poland must pay taxes according to local rules.

In recent years, Poland has become a place of residence for a significant number of Ukrainian citizens. According to the latest data, over 1.2 million Ukrainians live in the territory of this country. This requires them to know and comply with local laws and regulations, including participation in the country's tax system.

In Poland, tax rates vary depending on the type of income. Labor income is taxed on a progressive scale, where the percentage of taxation depends on the amount of earnings. Income earned abroad is also taxed at the same rates. For entrepreneurs, there is a choice between the general taxation system, a single rate, or a simplified system. Profits from investments and dividends are taxed at a fixed rate. The sale of property and interest on bank deposits are also taxed at a single rate. However, inheritance and social benefits are not subject to taxation.

In this country, the obligation to pay taxes arises only for tax residents of Poland.

It should be reminded that Ukrainians living in Poland have the opportunity to receive a pension only under certain conditions.

Read also

- Strategic Resource — How Many Gas Fields Are in Ukraine

- Minus 20 billion UAH — Hetmancev explained why the budget is losing money

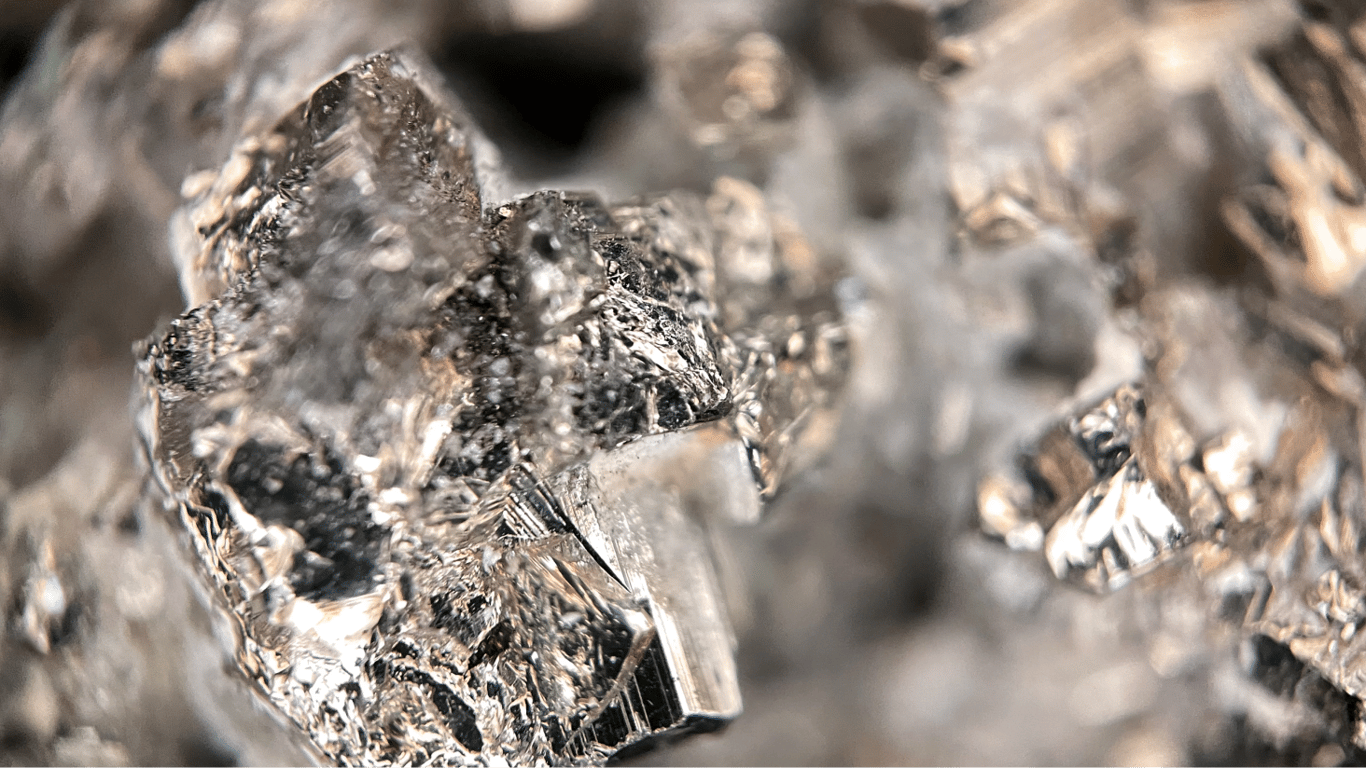

- Lithium Reserves of 490 Million Tons — What Valuable Metal Has Been Found in China

- Salary and Financial Assistance - What You Need to Know About Payments to Police Officers

- Housing in the capital has become more expensive — why buying has become easier

- Leaders of minerals - which metal is most abundant in Ukraine